How to get a tax refund after shopping in Thailand?

Thailand is always a country that attracts a lot of tourists every year. Not only because of the famous tourist attractions, but it also has many large shopping malls with many different types of goods.

To encourage tourists to shop while traveling in Thailand, this Golden Temple country has a tax refund policy when shopping at shopping centers and supermarkets. Tax refund procedures when shopping in Thailand have many things you need to pay attention to. How to get a tax refund after shopping in Thailand? Join us to find out!

1. Who can claim a VAT refund in Thailand

There are many people who come to Thailand not only for traveling but also for shopping. Thailand is one of the major shopping centers in Southeast Asia with many large shopping malls with luxury goods brands such as Chanel, Dior, Hermes, etc. Because of this, the Thai government has a VAT refund policy. So who can claim VAT refund in Thailand?

- The only people who can claim a VAT refund in Thailand are foreign (non-Thailand) tourists who come here for tourism and shopping.

- The tourists are leaving Thailand.

- And those who have stayed in Thailand for less than 180 days

How to claim a VAT refund?

How to get a VAT refund in Thailand is always of interest. The methods and procedures to refund VAT is quite simple, you can refer to the following steps.

Step 1: Shop at stores that allow VAT refund.

Step 2: Complete the tax refund application form.

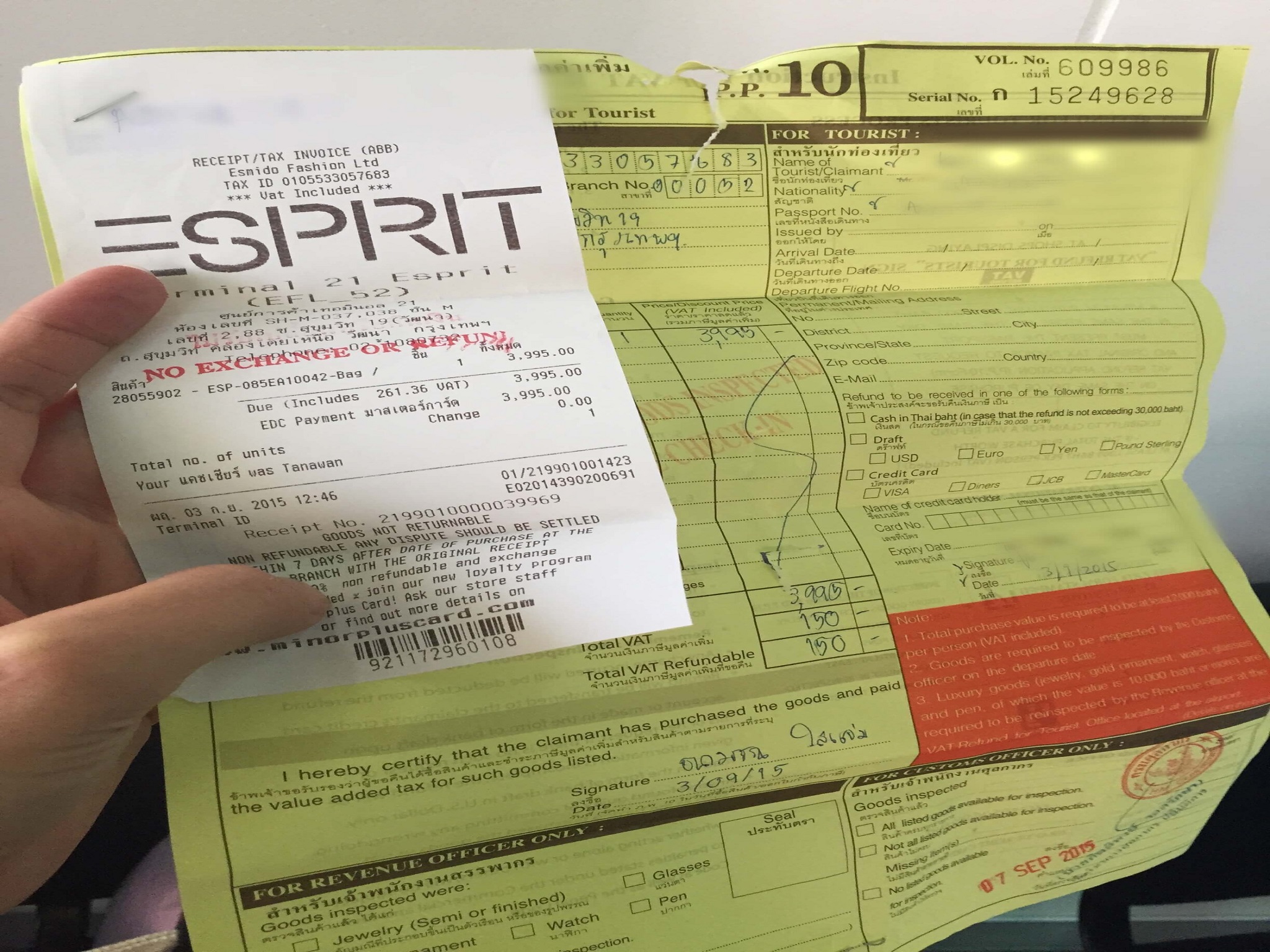

After shopping, travelers ask the clerk to get a VAT refund declaration.

Visitors must fill in the declaration form: Name, passport, address of your home country, date of arrival in Thailand, date of departure, flight number, method of refund (cash, card credit or bank check).

Store information to be filled in: date of invoice, details of sold goods, the total value of goods, amount to be refunded.

Step 3: Approve the application for a tax refund at the airport.

On leaving Thailand, travelers should arrive at the airport 1-2 hours early to queue for a travel refund. Guests will have to check out the "VAT Refund Application for Tourists" before checking in. Here customs staff will ask travelers to open luggage to check the product.

At the VAT refund counters, visitors must submit: Tax returns, invoices; Passport; Flight information of travelers.

If the visitor's form is valid, the customs officer will close the form confirming the refund on the visitor's form. Then, visitors hold this form to receive cash after check-in and through the border. At this time, visitors go to check-in as usual, send luggage and receive boarding pass cards on the plane.

Note: Visitors may have to carry some important items such as jewelry, branded products, glasses, pens, etc to check again before a refund, so you should not store these items in the onion depository.

Step 4: Complete the tax refund procedure.

After receiving the boarding pass, visitors must enter the quarantine area and leave the Thai border gate before reaching the tax refund counter. Follow the instructions to find the "VAT Refund Office" counter.

Guests line up, submit a completed tax return form to receive money.

The only people who can claim a VAT refund in Thailand are foreign (non-Thailand) tourists who come here for tourism and shopping

2. VAT refund fees and payment methods

What you are most interested in is probably the VAT refund fee in Thailand. Tourists are entitled to a 7% VAT refund when shopping for items from stores that accept "VAT Refund for Tourists" (VAT Refund to Tourists). When you see the "Refund for Tourists" logo placed in front of the store, you can receive a 7% VAT refund on purchases made at these stores.

But to receive this money, visitors must meet some conditions, and only received when tourists officially leave Thailand to another international airport.

The payment methods for tourists to choose are:

- If you receive cash, you will have to pay 100 Baht;

- If you receive a bank check, in addition to the charge of 100 Baht, you will have to pay additional postage;

- Receiving a refund via credit card or bank card, visitors will have to pay the appropriate transfer fee.

Each VAT refund invoice will incur a charge of 100 Baht.

Each VAT refund invoice will incur a charge of 100 Baht

3. VAT refund conditions

Tourists will often shop at stores in major shopping centers such as Siam Paragon, Central World and Big C supermarket systems, visitors will be refunded tax when in the conditions prescribed by the Thailand is as follows:

- You are a foreign tourist (not a Thai) and your stay in Thailand is less than 180 days.

- You are a tourist leaving Thailand.

- Passport is required when making purchases.

- Not a person who is serving on board of Thai airlines.

- A total of more than the minimum purchase of 5,000 Baht (visitors can accumulate the bill).

Tourists will often shop at stores in major shopping centers such as Siam Paragon, Central World and Big C supermarket systems, visitors will be refunded tax

Shopping is always a hobby for many people, so the implementation of the VAT refund policy of the Thai government to foreign tourists attracts more tourists. Hopefully hints on how to get a tax refund after shopping and tour in Thailand can help you.

Hang Moon

Image sources: Internet

Questions & Answers (2)

The price listed on the shop’s website in Thailand is that already including VAT? Or we have to pay on top of the list price

Hi, not all the shops include the tax in their available price, you should double check with the shop's owner.

Hi I am hoping to buy a new customised Macbook pro in Thailand via the online shop but wish to pick up the item from the Apple store in Bangkok. Do you know if the store staff will complete a VAT refund form (PP10) for me, to allow me to claim back the Thai tax. Many Thanks

Hi! Because not all stores in Thailand allow VAT refunds, you should ask the store carefully before deciding to buy from them. Usually, if the store allows the VAT refund, as long as you make payment directly at the store, they will give you a PP10 with the invoice so you can claim the VAT tax at VAT Refund counters in international airports in Thailand. On the other hand, you should ask the store if you pay online, can they help you to process an invoice and also PP10 on the day you pick up the item, or else you can't claim the Thai tax.